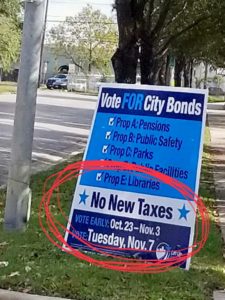

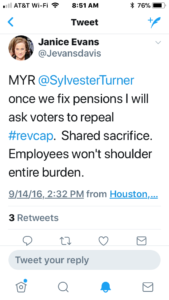

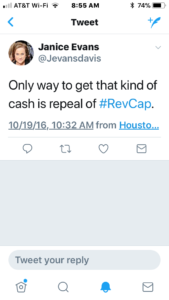

Days after the disastrous pension bond vote, the Houston Chronicle today called for the lifting of the revenue CAP. This means, for those in Rio Linda, that the local newspaper is telling politicians that your property taxes should increase. Sly and the Chron repeatedly said no new taxes with these bonds. Suckers!

I hate to say I told you so, but I told you so. And, if you read the ballot language, you were sufficiently warned.

Houstonians who either sat it out or voted for the bonds (Kingwood Tea Party), please make your checks payable to Sylvester Turner. Sly now has 1.5 billion dollars of your money to hand out to his friends secured by a lien on your real estate.

You can thank the Kingwood Tea Party, Mary Jane Smith’s The Texas View, C Club, and Houston Realty Breakfast Coalition, and community organizer Kevin Shuvalov for the aggressive “conservative” campaign to support the bonds. Special shout out to Harris County Republican Party Chair Paul Simpson for his efforts and support of the bonds.

Did your representatives support the bonds? Did they vote for SB 2190? We know that Lt. Dan, Jim Murphy, Joan Huffman, Dan Huberty supported the enabling legislation at the capital.

Revenue cap

Credit rating agencies have charted Houston’s path to fiscal responsibility.

It took less than a week for Houston to start reaping benefits from voter approval of a $1 billion bond and the associated pension reform deal.

On Monday, the rating agency Moody’s issued a report upgrading the city’s credit outlook.

Our overall grade remains unchanged at Aa3 — the fourth-highest — but we’ve been improved from “negative” to “stable.” A better credit rating means the city can borrow money at lower interest rates, saving taxpayers in the long run.

This doesn’t mean we’re done wrangling with the consequences of a blunderous 2001 pension package that’s left the city with billions in unfunded liabilities. City Hall still must walk a fiscal tightrope and ensure that public employee retirement obligations stay within the agreed-upon bounds of the pension reform deal. Laws don’t enforce themselves.

While it will take decades to get the city’s finances back in order, it is nice to know that we’re moving in the right direction. And, luckily for policymakers, the next steps to a better credit rating have already been delineated by Moody’s.

Houston must remove the revenue cap.

The amount of money that City Hall can collect each year in property taxes remains constrained by an arbitrary algorithm. If homeowners and businesses pay too much in property taxes, then the city is compelled to cut the rate. It gives Houstonians a couple extra bucks in their pockets at the end of the year, but denies City Hall tens of millions in much-needed revenue to help pay down pension obligations, pave roads, build parks and do all the usual work of municipal government.

However, while your elected officials remain constrained, the appointed boards of tax increment reinvestment zones face no limit on their ability to collect property taxes. Those TIRZ boards work by locking in the amount of tax revenue sent to City Hall in a certain neighborhood and then redirecting any new cash raised by a growth in property values. Revenue that would be capped at City Hall can be captured by TIRZs, forcing all of us to rely on their benevolence to spend on infrastructure, public safety and other basic services that City Hall can’t afford.

More likely, however, you can catch them spending on projects like an over-budget bus lane down the middle of Post Oak Boulevard or beautification projects that conveniently benefit big businesses.

TIRZs were originally crafted as a way for dilapidated neighborhoods to capture and reinvest growth. Instead they’ve been harnessed by the wealthiest parts of town — such as the Galleria area — to keep cash that could be spread across the rest of the city.

But until Houston removes the revenue cap, TIRZs will remain the only way to reap the tax dollars that should be collected during a property boom.

The two problems — revenue cap and TIRZs — remain inexorably linked. If Mayor Sylvester Turner wants to fix the first, he should find a way to address the second.

A better credit rating means the city can borrow money at better interest rates, saving taxpayers in the long run.

Permalink